When you take a pill, you probably don’t think about where it was made. But if you’re a patient relying on life-saving medicine, the factory that produced it matters more than you know. Two countries - China and India - supply most of the world’s generic drugs and active pharmaceutical ingredients (APIs). But their manufacturing systems, regulatory oversight, and risks are wildly different. And the U.S. Food and Drug Administration (FDA) is watching both closely - but not the same way.

Why China and India Dominate Global Drug Manufacturing

China produces about 80% of the world’s generic APIs. That’s the raw chemical backbone of most pills - from antibiotics to blood pressure meds. Its scale is unmatched. Factories in Jiangsu and Zhejiang churn out tons of ingredients at low cost, thanks to decades of state investment, cheap labor, and tight control over supply chains. But volume doesn’t always mean quality. In 2023, nearly 37% of Chinese pharmaceutical facilities faced FDA import alerts - warnings that products may be unsafe or non-compliant. That’s more than double the rate for Indian facilities. India, meanwhile, is the world’s third-largest drug producer by volume. It doesn’t make as many APIs as China, but it makes more finished medicines that meet Western standards. Over 100 Indian plants are FDA-approved - more than double China’s 28. Why? Because India built its reputation on compliance. After its 1970 patent law changed, local companies focused on making affordable generics that could be sold legally in the U.S. and Europe. That meant learning and following FDA rules - not just copying formulas.FDA Monitoring: A Tale of Two Countries

The FDA doesn’t just review paperwork. It sends inspectors to factories. And the results tell a clear story. Between 2020 and 2023, Indian facilities received 30% fewer Form 483 observations - the official notices of violations - than Chinese ones. That’s not luck. It’s culture. Indian manufacturers, especially the bigger ones, have embedded FDA regulations into their daily operations. Digital systems track every batch. Workers are trained on 21 CFR Part 211 - the FDA’s quality standards. Audits are routine, not reactive. One U.S. pharmaceutical executive told Bain & Company: "We trust Indian plants because we know what we’ll find when we walk in. In China, you never know if you’re getting a compliant facility or a ticking time bomb." China’s situation is more complex. The government has pushed hard to upgrade its pharma sector. Many factories now meet ISO and CE standards. But enforcement is uneven. Smaller suppliers, especially those outside major cities, still cut corners. Some use unapproved raw materials. Others falsify test results. The FDA has responded by increasing inspections and tightening import controls. But with over 5,000 pharmaceutical facilities in China, it’s impossible to monitor them all.The Hidden Risk: India’s Dependence on China

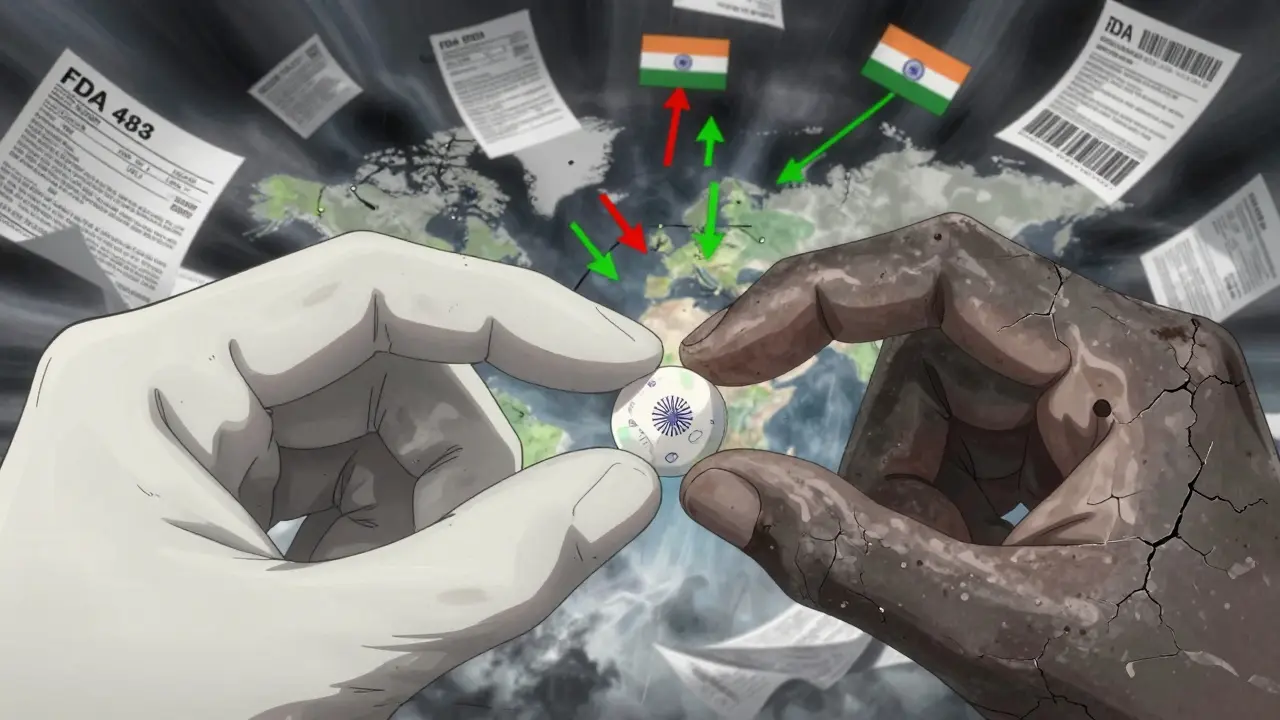

Here’s the irony: India, the compliance leader, is still deeply tied to China. In 2024, India imported 72% of its bulk drug ingredients from China - up from 66% just two years earlier. That means even if an Indian company makes a perfect tablet, the active ingredient inside might come from a Chinese plant under FDA scrutiny. This creates a single point of failure. If China shuts down exports - due to trade tensions, a pandemic, or a regulatory crackdown - India’s drug supply chain could collapse. A senior sourcing manager at a U.S. pharma company put it bluntly: "We’re trying to diversify, but we can’t replace China overnight. The cost and complexity are too high." India knows this. That’s why it launched its $3 billion Production-Linked Incentive (PLI) scheme in 2020. The goal? Build domestic API manufacturing. So far, it’s attracted $4 billion in investments. But progress is slow. Building a high-quality API plant takes years. It needs skilled chemists, clean rooms, and strict quality controls - none of which are easy to scale quickly.

China’s Strengths and India’s Weaknesses

China still wins on cost and scale. If you need 100 tons of metformin or ibuprofen, China can deliver it faster and cheaper than anyone. For markets with looser regulations - like parts of Africa or Latin America - Chinese manufacturers are often the only viable option. India’s edge is reliability. For Western markets - especially the U.S., EU, and Canada - FDA approval is non-negotiable. Indian companies have spent decades proving they can pass inspections. Their workforce speaks English. Their management understands Western audit expectations. And their regulatory system, while imperfect, is transparent and predictable. But India struggles with complexity. Its manufacturing base is fragmented. Instead of one big plant, you might need to work with 10 different suppliers for one drug. That increases risk and cost. China’s ecosystem is integrated. One company might control everything from raw chemicals to finished pills. That’s efficient - but risky if quality slips.The "China+1" Strategy Is Real - and It’s Working

After the pandemic exposed how fragile global supply chains are, Western companies started asking: "What if we can’t get anything from China?" The answer: "Go to India." This "China+1" strategy isn’t just a buzzword. It’s a shift in procurement. Major pharma firms are now signing long-term contracts with Indian manufacturers. They’re moving R&D and packaging operations there. And they’re investing in joint ventures to build new API plants. Why? Because India offers something China can’t easily replicate: consistent regulatory alignment. The FDA doesn’t have to guess whether an Indian plant is compliant. They’ve seen it again and again. In contrast, each Chinese facility feels like a new gamble. India’s revised Schedule M regulations, updated in 2023, are pushing even harder toward global standards. These rules require better documentation, real-time monitoring, and stricter environmental controls. Companies that comply are seeing fewer audit findings. Those that don’t are being shut out of export markets.

What This Means for Patients and Providers

For patients, the bottom line is safety. If your medicine comes from an FDA-approved Indian plant, you’re likely getting a product with stronger quality controls. If it’s from a Chinese facility with a history of import alerts, the risk is higher - even if the label says the same thing. For doctors and hospitals, it’s about trust. When a hospital chooses a generic drug, it’s not just picking the cheapest option. It’s choosing a supply chain. A hospital in New York might prefer an Indian-made generic over a Chinese one - not because it’s more expensive, but because its pharmacy team knows the audit history is cleaner. For regulators, the challenge is balancing access and safety. The FDA can’t stop imports from China - too many drugs rely on them. But it can increase scrutiny. And it can encourage diversification. That’s why the agency publicly praises India’s compliance efforts. It’s not just a compliment - it’s a strategy.The Future: Who Wins?

By 2030, China’s share of the global outsourced pharmaceutical market could drop by 10 percentage points. India, meanwhile, is projected to gain 20% to 30% of that lost share. Why? Because the world is no longer just looking for cheap drugs. It’s looking for reliable drugs. China is trying to move up the value chain - investing in biologics, gene therapies, and advanced manufacturing. It’s growing its biopharmaceutical market at 19.3% annually. But those are high-end products. The bulk of global demand is still for simple, low-cost generics. And that’s where India dominates - and where compliance matters most. India’s long-term goal? To go from being the world’s pharmacy to becoming its innovation hub. It wants to make biosimilars, not just copy old drugs. It wants to export not just pills, but science. But it can’t get there without fixing its API dependency. Until then, it’s playing a dangerous game - relying on the very country it’s trying to replace.What You Should Know

- If you’re a patient: Generic drugs from India are more likely to meet U.S. quality standards than those from China. Ask your pharmacist where your medicine is made. - If you’re a healthcare provider: Don’t assume all generics are equal. Check the manufacturer’s FDA inspection history. It’s public. - If you’re in supply chain management: India isn’t perfect, but it’s the safest alternative to China right now. Start building relationships there - now, before demand spikes. - If you’re a policymaker: Support domestic API production. Relying on one country for your medicine is a national security risk. The global drug supply chain is changing. China still makes the most. But India is becoming the most trusted. That shift isn’t about politics. It’s about quality. And in medicine, quality isn’t optional - it’s everything.Why does the FDA inspect drug factories in China and India?

The FDA inspects factories to make sure medicines meet U.S. safety and quality standards before they’re sold here. Even if a drug is made overseas, the FDA has the right to check how it’s made. If a factory has repeated violations - like falsified test results, dirty equipment, or unapproved ingredients - the FDA can block imports. This protects patients from unsafe or ineffective drugs.

Is medicine from India safer than from China?

Based on FDA inspection data, yes - on average. Indian manufacturing facilities have consistently received fewer violations than Chinese ones. Over 100 Indian plants are FDA-approved, compared to 28 in China. Indian companies have built their business models around meeting Western standards. Chinese factories vary widely - some are top-tier, others have serious compliance issues. The risk is higher in China, but not every Chinese-made drug is unsafe.

Why does India import so many APIs from China?

India has focused on making finished medicines, not raw ingredients. Building high-quality API plants is expensive and takes years. China has dominated API production for decades with lower costs and massive scale. Even though India wants to change this, it’s still cheaper and faster to import APIs from China than to make them domestically - for now.

What is the "China+1" strategy in pharma?

It’s a supply chain plan where companies reduce reliance on China by adding another country - usually India - as a backup. After the pandemic and rising geopolitical tensions, many U.S. and European drugmakers moved some production to India because of its better regulatory track record, skilled workforce, and English-speaking management. It’s not about replacing China entirely - it’s about reducing risk.

Are generic drugs from China and India the same as brand-name drugs?

Legally, yes - if they’re FDA-approved. Generic drugs must contain the same active ingredient, strength, and dosage form as the brand-name version. They must also be absorbed into the body at the same rate. But quality depends on the manufacturer. A poorly made generic from a non-compliant factory might not work as well or could cause side effects. That’s why FDA inspections matter.

Can I find out where my medicine was made?

Yes. Check the drug’s label or packaging - many now list the manufacturer’s name and location. You can also ask your pharmacist or search the FDA’s website for the manufacturer’s inspection history. If the label says "Manufactured for" followed by a U.S. company, that’s often a distributor - the real maker is overseas. Look for the actual production site listed in the package insert.

Is India’s pharmaceutical industry growing faster than China’s?

In terms of exports and regulatory trust, yes. India’s pharmaceutical exports are projected to grow 10- to 15-fold by 2047, reaching $350 billion. China’s growth is slowing in generics due to rising costs and regulatory pressure. While China leads in biologics and innovation, India is gaining ground in affordable, high-quality generics - the backbone of global healthcare. India’s focus on compliance is attracting more Western investment than China’s.