Buying prescription drugs without insurance used to mean paying full retail price - often $100 or more for a month’s supply of a common generic. Today, you can walk into a pharmacy or click a button online and pay as little as $5 for the same pill. But here’s the catch: direct-to-consumer generic pharmacies don’t always save you money. Sometimes, they cost more. And sometimes, they don’t even have the drug you need.

What Are Direct-to-Consumer Pharmacies?

Direct-to-consumer (DTC) pharmacies sell prescription drugs straight to you - no insurance, no pharmacy benefit manager (PBM), no middlemen. You pay cash, and they give you the price upfront. No hidden rebates. No confusing formularies. Just cost plus a small markup.

Companies like Mark Cuban Cost Plus Drug Company, Amazon Pharmacy, Costco, Walmart, and Health Warehouse built these services between 2020 and 2021. They were born from frustration. People were getting hit with $500 bills for $5 pills because of how PBMs worked. DTC pharmacies promised transparency. And for some drugs, they delivered.

When DTC Pharmacies Save You Big Money

If you’re buying an expensive generic - think drugs used for rare conditions, cancer support, or chronic autoimmune diseases - DTC pharmacies can cut your bill by 70% or more.

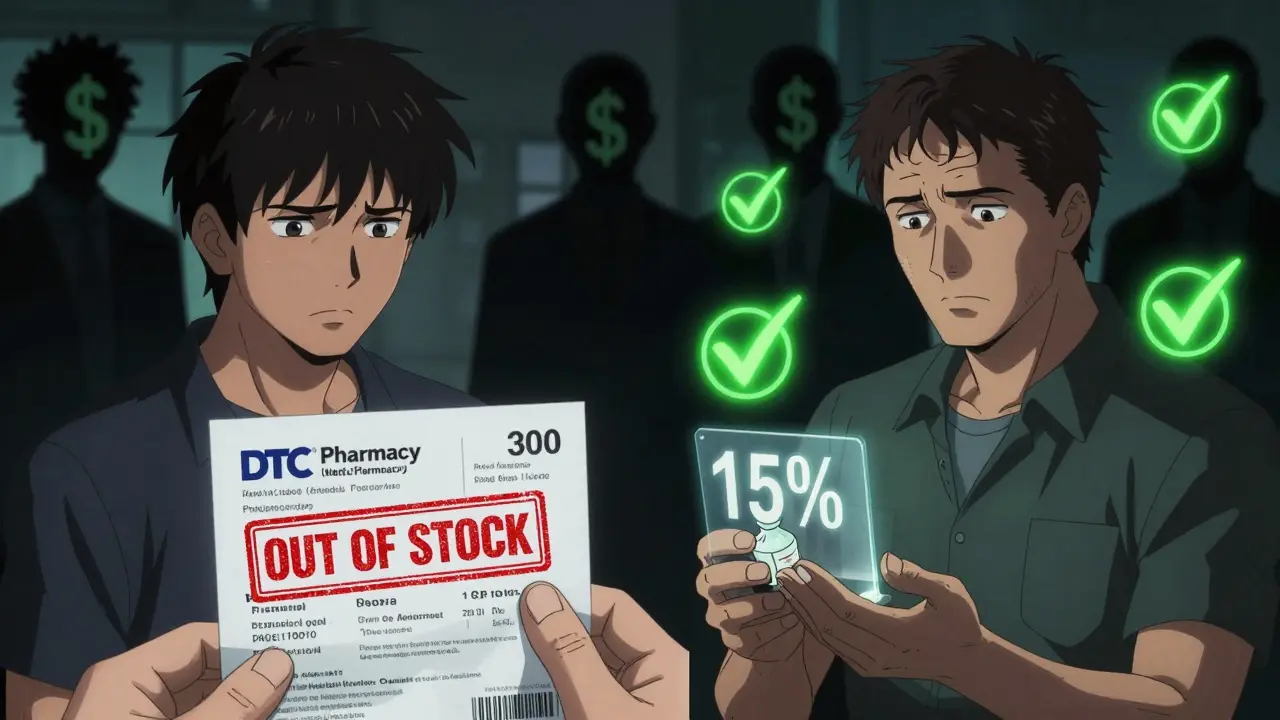

A 2024 study in the Journal of General Internal Medicine looked at the 50 most costly generic drugs covered by Medicare. For those, the median savings at DTC pharmacies was $231 per prescription compared to regular retail prices. That’s not a typo. One pill could go from $300 to $70. Amazon Pharmacy had the lowest price on nearly half of these drugs. Mark Cuban Cost Plus Drug Company came in second, offering a clear 15% markup on cost - no tricks.

Take gabapentin, used for nerve pain. At a local pharmacy, it might cost $120 without insurance. At Amazon, it’s $17. At Mark Cuban’s site, $14. That’s not a deal. That’s a revolution.

But for Common Drugs? Not So Much

Now, flip to the 50 most common generics - things like metformin for diabetes, lisinopril for blood pressure, or atorvastatin for cholesterol. These are the pills millions take every day.

Here, the savings shrink. The median savings? Just $19 per prescription. That’s nice, but not life-changing. And here’s the real problem: you have to shop around to find it.

Costco often wins for common generics. Amazon and Walmart are close behind. Mark Cuban’s site? He’s not even competitive on these. Why? Because his model is built for high-cost drugs, not the low-margin staples. If you’re paying cash for metformin, you’re probably better off walking into Costco and paying $5 for a 30-day supply - no website, no login, no waiting for shipping.

What DTC Pharmacies Don’t Tell You

One in five of the most expensive generic drugs? They’re simply not available on any major DTC pharmacy site.

That’s not a glitch. That’s a design flaw. Companies like Mark Cuban Cost Plus Drug Company only stock what they can source cheaply and reliably. If a drug is hard to get, has low demand, or is made by a single supplier, they skip it. So if you’re on a rare medication - say, for a neurological condition - you might spend hours searching online, only to find none of the DTC sites carry it.

A 2023 study by CVS Health looked at 79 neurological generics. Mark Cuban’s pharmacy carried only 33 of them. And of those 33, only two were cheaper than what insured patients paid out-of-pocket through their insurance plan. That’s not saving money. That’s a dead end.

Insurance Isn’t the Enemy - PBMs Are

Many people think insurance is the problem. But it’s not. It’s the Pharmacy Benefit Managers (PBMs) - the middlemen who negotiate prices between drugmakers, insurers, and pharmacies. They get rebates. They hide discounts. They make you pay more to get less.

DTC pharmacies cut out the PBM entirely. That’s why their prices are so low. But here’s the irony: if you have good insurance, you might already be paying less than you think. The USC Schaeffer Center found that 90% of commonly prescribed generics in Medicare Part D cost less than $20 at Costco - even without insurance. And if your insurance plan has low copays, you might be paying $5 or $10 anyway.

So asking “Should I use insurance or DTC?” is the wrong question. The right question is: “Where’s the lowest price for my drug, right now?”

The Hidden Cost: Time

Saving $200 sounds great - until you realize you have to check five different websites for every single prescription. For one drug, maybe you can do it. For five? Ten? If you’re managing diabetes, high blood pressure, thyroid issues, and depression, you’re looking at 10+ prescriptions.

Each one needs its own search. Each one has different availability. Each one has different shipping times. Some DTC pharmacies ship in 2 days. Others take 7. Some require a new prescription from your doctor. Others won’t refill without a new form.

There’s no app that compares all of them. No tool that tells you, “Amazon has your lisinopril for $6.50. Walmart has it for $7.20. Your insurance copay is $5.” You’re on your own.

That’s the real trade-off. Time vs. money. If you’re young, tech-savvy, and have a few hours a month to shop around, DTC pharmacies can save you hundreds. If you’re elderly, on multiple meds, and just want to pick up your pills and go? You’re better off sticking with your local pharmacy - even if it costs a little more.

Who Benefits Most From DTC Pharmacies?

There are three groups who win big:

- The uninsured - If you don’t have insurance, DTC pharmacies are your only hope for affordable generics. No PBM. No copay. Just cash.

- The underinsured - High-deductible plans mean you pay full price until you hit your deductible. For expensive drugs, DTC can be the only way to afford them.

- The price-sensitive shoppers - You’re willing to spend 15 minutes on your phone comparing prices. You check GoodRx, Amazon, and Mark Cuban’s site before buying. You’re not afraid to wait a few days for shipping.

Everyone else? You’re probably better off with your insurance plan - especially if your plan already gives you low copays on generics.

The Bottom Line: Don’t Assume, Check

There’s no universal answer. DTC pharmacies aren’t magic. They’re not always cheaper. They don’t carry everything. But they’re not a scam either.

Here’s what to do:

- Find your exact drug - name, dose, quantity.

- Check your insurance copay first. Log into your plan’s website.

- Then check GoodRx. It shows cash prices at local pharmacies.

- Now check DTC sites: Amazon, Mark Cuban Cost Plus Drug Company, Costco, Walmart, Health Warehouse.

- Compare shipping times. Can you wait 5 days? Or do you need it tomorrow?

- Choose the lowest price that works for your timeline.

For expensive generics? Always check DTC. You’ll likely save hundreds.

For common ones? Compare. Sometimes your insurance wins. Sometimes Costco does. Sometimes Amazon does. There’s no rule - only data.

And if you can’t find your drug anywhere? Talk to your doctor. Maybe there’s a similar generic. Or maybe your insurance can get it covered with a prior authorization. Don’t give up. Just don’t assume the cheapest option is the easiest one.

Are direct-to-consumer pharmacies safe?

Yes - if you use licensed, reputable companies. Mark Cuban Cost Plus Drug Company, Amazon Pharmacy, Costco, and Walmart are all licensed and regulated. They source drugs from FDA-approved suppliers. Avoid random websites that don’t require a prescription or show no physical address. Stick to the big names.

Can I use DTC pharmacies if I have Medicare?

You can, but you shouldn’t use them to fill prescriptions under your Medicare Part D plan. If you pay cash at a DTC pharmacy, that purchase won’t count toward your deductible or out-of-pocket maximum. You’ll still have to pay full price until you hit your limit. Only use DTC if you’re paying out-of-pocket and want to avoid using your Part D benefits.

Why doesn’t my insurance cover DTC pharmacies?

Because DTC pharmacies don’t contract with insurance companies. They operate outside the PBM network. Your insurance only pays pharmacies that are in its network. If you use a DTC pharmacy, you’re paying cash - and your insurance won’t help. That’s not a flaw - it’s how the system works.

Is Mark Cuban Cost Plus Drug Company really cheaper?

For expensive generics - yes, often. For common ones - rarely. Their 15% markup is transparent, but they don’t carry all drugs. A 2024 study found they had the lowest price on 26% of expensive generics, but only 10% of common ones. They’re not the cheapest for everything - just the most transparent.

What if I can’t find my drug on any DTC site?

Check your local pharmacy’s cash price. Sometimes Walmart or Costco has it cheaper than online. If not, ask your doctor if there’s a therapeutic alternative - another drug that works the same way. You can also ask your insurance company to do a prior authorization. Sometimes they’ll approve a drug even if it’s not on their formulary.

What Comes Next?

The pharmacy world is changing. More people are paying cash. More companies are joining the DTC space. But the system is still broken - not because of DTC pharmacies, but because we have no simple way to compare prices across all options.

Until a tool exists that shows you the real price - insurance copay, GoodRx, Amazon, Costco, and Mark Cuban - all in one place - you’ll have to do the work yourself. It’s time-consuming. It’s frustrating. But for the right drugs, it’s worth it.

Don’t let anyone tell you DTC pharmacies are the answer. Or the enemy. They’re a tool. And like any tool, they’re only useful if you know how - and when - to use them.